Building generational wealth should be at the top of mind for every adult on the planet, in my humble opinion. Who doesn't want a better life for their children and grandchildren. Well according to the latest statistics, not many. Generation wealth is achievable for everyone on the planet but you know what stops the majority from getting it? Sacrifice!

If I told you that I could guarantee that your future descendants can live the most amazing life ever but there's just one catch, would you be intrigued? Most would be intrigued by such a proposition but of course their willingness to take the offer or walk away depends on that proverbial "catch." Here's the catch. In order for your grandchildren and all future descendants of yours to live the most amazing life ever, YOU have to live like crap for 10 year. I chose live like crap so they'll never have to

I know you're probably thinking, "what exactly do you mean...live like crap?" Almost anything on earth no matter how hard can be accomplished with intense focus for 10 years. When I say live like "crap" I mean a stripped down, bare bones minimum existence. Absolutely no extras, nothing above basic necessities. Things that you can actually live without, you go without them. No cable TV, no $5 lattes, no ball games, nothing but basic necessities for 10 years.

Most stand up guys are thinking, I can do that in a heart beat. Women for the most part have become accustomed to sacrificing for everyone else and are probably thinking this is nothing . Keep in mind though ladies, if you don't need it to live, you can't have it. No make up, no hair dresser, no perfumes and expensive body washes...just the bare necessities for 10 years. Men and women alike with any love for their children and future descendants will still likely agree that this is a fair exchange. You'll build generational wealth and your grandchildren and future descendants will live amazing lives because of your sacrifice and willingness to live like crap for the next 10 years. Here's where it gets interesting though. If at the time of this reading you don't have any children, you are truly in the best position to build generational wealth and leave a solid legacy using the plan that I'll outline below. However, if you already have children, this challenge just intensified 100X. If you're looking to build generational wealth and you already have children, then guess what. You have to convince them of the bare bones minimum lifestyle for 10 years too. No birthday parties, extra curricular activities at school, proms and homecomings don't exist, no Christmas, yep no Christmas at least not in the hyper commercialized way. Remember, this is a guarantee that their children will never know struggle and all of their descendants going forward will live the most amazing lives ever if they are willing to sacrifice for 10 years. Thing you can get the kiddos on board? Or is this the place where you check out and say things like, "money ain't everything," or "money can't buy happiness" or "the best things in life are free." Funny how we're quick to rationalize our current state when things get just a tab bit challenging. 10 Year Generational Wealth BluePrint

So...if you're still reading at this point you either don't have kids or you're intrigued enough to at least want to know what the plan is that you'll be convincing the children to buy into, right? Either way I'm glad you've decided to stick around. Just remember this blueprint is designed for an intense 10 year plan that will ensure that your grandchildren are wealthy, not You, not your children. However, I'll roll out an abbreviated plan that can get you there as well, cool?

"Why a bare bones minimum for 10 years?" you ask. It's simple, you have to understand the time interest on money. See, inflation cause money to lose value every single day. Therefore, in order to use money most effectively you have to exchange as much of it as possible and as often as possible for something that's going to at least retain it's value at the rate of inflation or grow in value at a pace faster than inflation. If inflation, historically, has increased at a rate of 2% annually and you're not getting a 2% increase on your job and your interest on your savings account is less than that, are you beginning to see why you're losing financially. Is it making sense to you why you have to do something as radical as a bare bones minimum lifestyle for 10 years. You need to take every single dollar you get above what it takes to live a bare bones minimum lifestyle and put it towards building generational wealth for the next 10 years. This will ensure that your grandchildren will inherit wealth and never have to worry about money. The 10 year generational wealth blueprint is simple, however we never confuse simple with easy. You're going to take every dime you get for the next 10 years and aim at 1 or 2 things, paying down debt or investing for double digit returns (see video below, most don't believe in getting double digit returns). That's it, that's the blueprint. If you do that for 10 straight years, no parties, no expensive dinners, no name brands, packed lunches for work, no upgrades in lifestyle whatsoever. A span of 10 year with this type of intense focus will change your life and your financial family tree forever. Numbers Never Lie

Disclaimer: This is NOT financial advise as I am not a licensed planner or advisor and NOT authorize to give financial advise. These examples are hypothetical and for information purposes only.

Now that we got that out the way let's look at some numbers. Say at the beginning of year 1 you literally cut all the fluff out of your life. No paid TV, gym membership gone, movie night cancelled, kids activities come to an end unless the can get sponsored, no more ripping and running burning valuable gas, all the things that we're "train" to do in a capitalistic society come to an end. For the average American household that would save a minimum of $500 per month. You save every single dime of the $500 for the first 6 months, now you have a $3,000 mini emergency fund established. Now that the mini emergency fund is established you spend the next 18 months attacking your debt with vengeance. You apply the $500 plus the original payment to the smallest balance owed and you do that until the balance is wiped out. The funny thing is, some of us have debts and the balance is less than $500 but instead of paying it off we pay the minimum and let the interest continue to compound. If the smallest balance had a $100 minimum payment, when you pay it off you've increased your monthly cash flow by $100. Now you have $600 to apply to the next lowest debt balance and you repeat the process until all of your debts are wiped out with the exception of your mortgage. Car notes, furniture, student loans, credit cards, cell phone leases, get rid of all of them. For the sake of time we're going to say you've done that and it took all of 3 years. Assuming that you have lost your job or lost any significant income, chances are you're $1500 - $2500 or more cash flow positive. Meaning the debt is gone but after you pay your mortgage and other residual bills, light, gas, water etc. you have money left over, that amount is your monthly cash flow. Save Your Money and Your Money Will Save You

Let's be clear about one thing here. When I say "save your money" I'm not talking about putting it into a savings account. I'm talking about safe guarding it with your decisions and not letting it get away from you in a senseless fashion. If you make a habit of treating your money this way, it will in turn safe guard you as well. Now let's talk about what you can do with an extra $1500 per month for 7 years that will build generational wealth for you and your family.

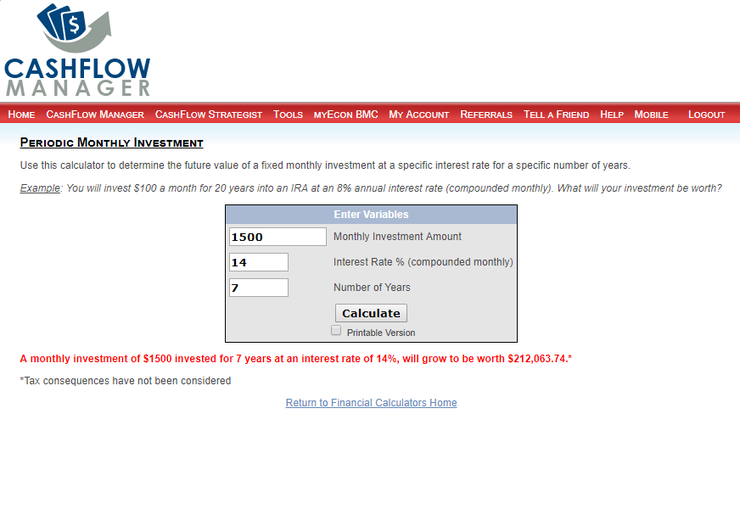

The image above is a financial calculator called the CashFlow Manager in it I've plugged in your monthly cash flow of $1500 per month at 14% rate of return for 7 years, as it took 3 years to pay off debt and build the $1500 monthly cash flow. As you can see at a generous 14% your money would grow to $212,063.74. Now, let me reiterate, this plan is for generational wealth building, it's not for "YOU" to become wealthy it's for your grandchildren to inherit wealth. I can see you thinking that $212k is not a lot of wealth. Hang with me, let me show you how the grandbabies will inherit wealth then we'll talk about an accelerated plan for you to enjoy a little wealth.

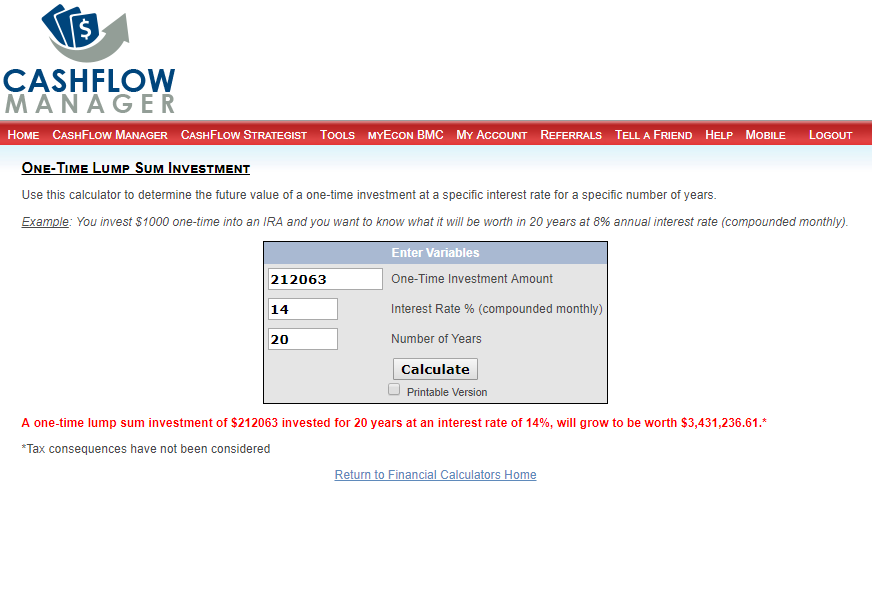

Lookie, lookie, lookie what 10 short years of sacrifice has produced. You basically lived like a hermit for 10 years so that your grandchildren can inherit $3,431,236.61. Do you think it'd be worth it. Can you do something this radical to end poverty in your bloodline forever? Because naturally you're going to be required to learn how this stuff works. This is just a silly example but as you're cutting back on your lifestyle, not going out as much, there's no cable TV so chances are you have a ton of free time. Might as well learn to invest, learn the real rules of capitalism. See I can say that you can end poverty in your bloodline forever because when you learn this stuff, you teach it to your children. When they inherit this wealth they have the financial I.Q. to manage it and make it grow.

Is it going to be easy, not at all. To pull something like this off, you have to fight like hell. Fight against those that don't understand and those that are satisfied with the status quo. You might have to fight with your mate as they might not be able to see the bigger picture. You're definitely going to have to fight with your children, at least early one, because they won't understand how saving $20 bucks on a movie ticket will radically change their future. But most of all you're going to have to fight with yourself. You have to fight to rise above average, you'll have to fight to stay disciplined and remain or course. It takes courage to build wealth. In the words of Damon Dash, "I hustle for my last name!" I encourage you to do the same. It's worth it and building generation is not only an option, it's our obligation! Wondering Where You Get Double Digit Returns? Check out this video and you'll see. This is how

|

|

|

|

|

|

|

Project 1,000 is teaching working class people to systematically build wealth for future generations. Click here to learn more!

If you liked this post share with a friend. If you didn't like it, leave us a comment so we can do better next time!

Maryland has 5 of the top 10 wealthiest black communities in the country and three of these communities are in Prince George County. I don't know about you but I never imagined that 5 of the richest black communities would be in Maryland.

10. Uniondale, NY - Average family income $76,553

9. Hillcrest, NY - Average family income $76,960

8. Friendly MD, - Average family income $82,827

7. Woodmore, MD - Average family income $103,438

6. Kettering, MD - Average family income $107,008

5. Fort Washington, MD - Average family income $114,243

4. Mitchellville, MD - Average family income $118,824

3. Ladera Heights, CA - Average family income $132,824

2. Baldwin Hills, CA - also know as Black Beverly Hills Average family income $157,033

1. View Park-Windsor, CA - Average family income $159,168

I would have thought Georgia would have made the list. After all some do consider it the Black Mecca. Can you even have a Mecca without a significant amount of wealth. Oh well...perhaps that's a post for another day. Comment and let us know what you think of this list.

10. Uniondale, NY - Average family income $76,553

9. Hillcrest, NY - Average family income $76,960

8. Friendly MD, - Average family income $82,827

7. Woodmore, MD - Average family income $103,438

6. Kettering, MD - Average family income $107,008

5. Fort Washington, MD - Average family income $114,243

4. Mitchellville, MD - Average family income $118,824

3. Ladera Heights, CA - Average family income $132,824

2. Baldwin Hills, CA - also know as Black Beverly Hills Average family income $157,033

1. View Park-Windsor, CA - Average family income $159,168

I would have thought Georgia would have made the list. After all some do consider it the Black Mecca. Can you even have a Mecca without a significant amount of wealth. Oh well...perhaps that's a post for another day. Comment and let us know what you think of this list.

10 Richest Black Communities in America

Leave us a comment and let us know what you think of this list. Are there any communities that we missed! Share if you like this kinda stuff.

What do wealthy people know about money that you don't? You'd be surprised...Check out Project 1,000 and get a glimpse of the secrets that they're using daily to build, grow and maintain their wealth. Funny thing is though, you can use these secrets too. Click here to learn how!

Today Donald J Trump was sworn in as the 45th president of the United States of America. During his inauguration speech he talked about how we're now in a "day of action" alluding to the fact that in the past politicians have traditionally been all talk and no action. While that's true regarding many politicians, that's also true among the people.

We live in what's know as a capitalistic democracy meaning that we have the freedom to be entrepreneurs and access the same free enterprise system as all of the fortune 500 companies and reap all of the same benefits of doing so. However like most politicians many individuals are all talk and no action. I hear people all the time talk of their grand ideas and how they are sure fire money makers and yet they're taking absolutely "NO" action toward manifesting those ideas, dreams and goals.

The one thing I will admit about President Trump is that, he did speak as though he believed deeply in the core message of is speech to help America rise from the ashes, bring jobs back and so on. The individuals that speak boldly about their dreams and business ideas too speak about them with conviction in their voice until of course you ask them "why aren't the executing?" What President Trump will actually do to deliver on his promise in this "Day of Action" remains to be seen, but it's my hope the he does actually take action. Just as it's my hope that you actually take action towards your dreams and goals and that you pursue them with a vigor that's required to manifest them into reality.

We live in what's know as a capitalistic democracy meaning that we have the freedom to be entrepreneurs and access the same free enterprise system as all of the fortune 500 companies and reap all of the same benefits of doing so. However like most politicians many individuals are all talk and no action. I hear people all the time talk of their grand ideas and how they are sure fire money makers and yet they're taking absolutely "NO" action toward manifesting those ideas, dreams and goals.

The one thing I will admit about President Trump is that, he did speak as though he believed deeply in the core message of is speech to help America rise from the ashes, bring jobs back and so on. The individuals that speak boldly about their dreams and business ideas too speak about them with conviction in their voice until of course you ask them "why aren't the executing?" What President Trump will actually do to deliver on his promise in this "Day of Action" remains to be seen, but it's my hope the he does actually take action. Just as it's my hope that you actually take action towards your dreams and goals and that you pursue them with a vigor that's required to manifest them into reality.

President Donald J Trump's Complete Inauguration Speech

Are you ready to "Take Action" today to bring your dreams to life? Join the Young Wealth Builders today and start building your family empire from scratch!

CLICK HERE TO LEARN MORE!

Author

H Cortez aka Financial Health Mentor to the Working Class

Dave Ramsay Course

Life Insurance Quote/Review

Credit Restoration Made Easy

Buy Now!

Erase Debt for Good

Join My Team NOW!

CashBack Shopping

Identity Protection

Affordable Roadside

Supplemental Insurance

Best Book for

Tax Tips

Archives

January 2018

December 2017

October 2017

September 2017

August 2017

July 2017

June 2017

May 2017

April 2017

March 2017

February 2017

January 2017

December 2016

November 2016

June 2016

Categories

All

Black Economic Empowerment

Branding

Current Events

Home Based Business

How To Build Wealth

How To Reduce Taxes

Internet Marketing

Investing

Talking Money In The Morning LIVE Archives

Wealthy Black People

RSS Feed

RSS Feed